Does Insurance Cover Hearing Aids in 2024?

As we step into 2024, the question of whether health insurance will cover hearing aids becomes more pertinent than ever. About 1 in 4 Americans aged 12 and above have some hearing loss. This estimate comes from a 2016 study in the “American Journal of Public Health.” The need for affordable and accessible hearing care is very important.

Recent breakthroughs have sparked a wave of competition and innovation in the industry. An example is the FDA’s approval of over-the-counter (OTC) hearing aids in August 2022. This has cut costs and increased access, but the maze of insurance policies and coverage options can leave many scratching their heads, especially when hearing aids can cost thousands of dollars per pair.

The Shifting Landscape of Hearing Aid Coverage

The arrival of OTC hearing aids has disrupted the industry. Brands like Jabra Enhance and Eargo now sell devices for under $3,000 per pair. This is a big discount compared to traditional prescription hearing aids, which range from $3,000 to $7,500 per pair, according to research. This influx of competition has prompted companies to reevaluate their product offerings, services, and relationships with insurance providers, paving the way for more comprehensive coverage options in the future.

For instance, in January 2023, Eargo partnered with supplemental benefits provider NationsBenefits. It allows members to buy Eargo’s OTC hearing aids using their supplemental benefits. MDHearing joined forces with healthcare company Medline to bring OTC hearing aids to Medicare Advantage and Medicaid subscribers, slated for rollout in 2024.

Moreover, the proposed Medicare Hearing Aid Coverage Act (H.R. 244), reintroduced to Congress in early 2023, aims to expand Medicare coverage for the estimated 45% of beneficiaries reporting hearing loss, according to a 2021 “HealthAffairs” article.

While the landscape is shifting, the road to comprehensive hearing aid coverage remains winding. Let’s explore the current state of coverage across various insurance types.

Common Insurance Plans and Hearing Aid Coverage

Freepik | rawpixel.com | Private insurance plans cover hearing tests but often exclude hearing aid costs.

Private Health Insurance

Most major private insurance plans cover diagnostic hearing tests but often exclude hearing aid treatment costs. However, a handful of states mandate hearing aid coverage, although exemptions and specific rules apply.

“Diverse insurance plans come with varying degrees of coverage,” explains Ruth Reisman, a licensed audiologist and co-owner of Urban Hearing located in Brooklyn, New York. “Coverage often entails a percentage contribution towards hearing aids, typically after meeting deductibles and out-of-pocket expenses, or may limit replacements to specific intervals.”

However, an exception lies in hearing aid coverage for children, where many insurance plans, including Medicaid, extend coverage for devices and examinations for those below 18 years old. Highlighting the importance of early intervention, a 2020 review in the “Journal of the American Medical Association” underscores the significant enhancement in the quality of life and self-esteem for children with hearing impairments through the use of hearing aids.

To ascertain whether your insurance plan encompasses hearing aid expenses, it is advisable to review your insurance provider’s policy documentation or directly engage with them. Companies such as Aetna often provide comprehensive online resources delineating coverage parameters, endorsed devices, and associated research findings.”

Medicare

Medicare is the government-funded insurance program for those aged 65 and above (or with qualifying conditions). It offers different levels of hearing aid coverage based on the plan type. Original Medicare (Parts A and B) explicitly excludes hearing aids and exams, except diagnostic exams deemed medically necessary under Part B.

However, Medicare Advantage plans (Part C), offered by private insurers, may include hearing care benefits like routine exams, hearing aid coverage, and professional fittings. Coverage and costs vary by location, plan, and provider, so thorough research is essential.

For example, some insurers partner with third-party managed care companies like NationsHearing or TruHearing. They do this to provide discounted hearing aid prices and limited long-term care coverage. But, the beneficiary often faces out-of-pocket costs.

Medicaid

Within the realms of healthcare accessibility, Medicaid stands as a pivotal resource, catering to the healthcare needs of low-income families through federal and state funding. Specifically, for children, Medicaid extends hearing aid coverage through the Early and Periodic Screening, Diagnostic, and Treatment (EPSDT) program, a mandatory provision across all states, ensuring timely and comprehensive healthcare services.

However, when it comes to adults, the landscape of coverage experiences significant variation from state to state. While some states offer coverage for specific hearing aid products and services, others may provide no coverage at all. To navigate this terrain, the Hearing Loss Association of America maintains an invaluable resource—a detailed compendium of state-by-state Medicaid policies pertaining to adult hearing care, aiding individuals in understanding the scope of available assistance within their respective regions.

Veterans Affairs (VA) Healthcare

The VA healthcare system is the nation’s largest employer of hearing professionals. It offers full coverage for hearing tests and top hearing aids (if needed). It covers fittings, repairs, batteries, and accessories for veterans in the program.

If your hearing changed during military service, you may be eligible for disability compensation based on the severity of your service-connected condition.

Workers’ Compensation

You may qualify for workers’ compensation if your hearing loss is due to job conditions or trauma. However, approval can be challenging unless the hearing loss results from a clear, documented workplace incident, as other environmental factors can also contribute to hearing impairment. All states offer workers’ compensation for hearing loss. But, the terms and criteria vary. So, consult your local division for guidelines.

Insurance Providers vs. Managed Care Providers

When navigating hearing aid coverage, it’s crucial to distinguish between insurance providers and third-party managed care providers.

Insurance providers offer benefits to you. Managed care providers like NationsHearing or TruHearing partner with insurers to offer more hearing care benefits, usually at discounted upfront prices. But, there may be out-of-pocket costs for long-term care and limited provider networks.

When purchasing through a managed care provider, you’ll typically have the hearing aids sent to a contracted clinic for a professional fitting, incurring an additional “fitting fee.”

State-by-State Breakdown: Mandated Coverage

Private insurance and Medicaid follow state-specific rules that divide the nation into two categories: states that mandate hearing aid coverage and those that don’t.

For Private Insurance: Most states don’t mandate hearing aid coverage, but a handful do, including Arkansas, Connecticut, Delaware, Maryland, Missouri, New Jersey, New Mexico, Oklahoma, Oregon, and Rhode Island. But, even in mandated states, some plans may be exempt, so always check with your provider.

These states cover hearing aids for adults on Medicaid: Alaska, California, Connecticut, Florida, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Massachusetts, Michigan, Minnesota, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Dakota, Ohio, Oregon, Rhode Island, South Dakota, Texas, Vermont, Washington, Wisconsin, and Wyoming.

The remaining states do not cover adult hearing care through Medicaid. It’s important to note that policies are subject to change, so stay informed about updates from your state and insurance provider.

Private Insurance Programs and Hearing Aid Coverage

Let’s explore how some of the nation’s major private insurance providers approach hearing aid coverage.

Tricare

Tricare is a government healthcare program for active-duty and retired military members and their families. It covers hearing aids for active-duty members and dependents under specific conditions.

- Hearing threshold of at least 40 decibels in one or both ears at specific frequencies

- Hearing threshold of at least 26 decibels in one or both ears at three or more specific frequencies

- Speech recognition score below 94%

- Children with a hearing threshold of at least 26 decibels in one or both ears at specific frequencies

Retired military members must enroll in VA healthcare to receive hearing care coverage.

Aetna

Most Aetna plans exclude hearing aid coverage, but those that do cover them follow strict criteria deeming the devices medically necessary, similar to Tricare. Covered devices may include FDA-cleared OTC hearing aids if recommended by a doctor.

To explore plan options, use Aetna’s “explore plans” tool, entering your ZIP code and personal information to receive recommended plans. Select “plan details” to review each plan’s hearing aid policy. Aetna also offers hearing benefits through some Medicare Advantage plans provided by its partner NationsHearing.

Blue Cross Blue Shield (BCBS)

BCBS plans vary by state, and the provider does not offer a publicly available clinical policy for hearing aids. However, some BCBS plans offer exclusive discounts on hearing aids through the Blue365 program, providing savings of up to 60% off retail prices with partners like TruHearing.

To explore options, visit the BCBS website. Enter your membership details or ZIP code. Also, contact your local provider for plan details. BCBS also offers hearing benefits through select Medicare Advantage plans, which you can browse using their online tool.

Cigna Some

Cigna plans cover hearing devices deemed medically necessary by an audiologist, as well as batteries, repairs, and replacements outside of the manufacturer’s warranty. Use Cigna’s browsing tool to explore medical plans in your area, or log into your existing myCigna account to review your plan’s details. Cigna also offers Medicare Advantage plans with potential hearing aid coverage, which you can explore using their “shop and compare” tool or online quiz.

Humana

Humana’s standard policies may not include hearing coverage. But, the insurer offers supplemental Humana Extend plans in some states. These plans provide varying levels of dental, vision, and hearing coverage. If you have an existing Humana plan, log in to review your benefits or explore adding a Humana Extend policy. Humana also offers Medicare Advantage plans with potential hearing aid coverage, which you can browse and quote online by entering your ZIP code.

United Healthcare (UHC)

UHC’s medical plans generally do not cover hearing aids, but some dental plans may include hearing benefits – so be sure to check the details of each dental option. UHC partners with UHC Hearing to provide benefits for Medicare Advantage plans. They include free online hearing tests and discounts on hearing aids, including top-rated OTC and prescription models. Full coverage is possible depending on your location and dual Medicare/Medicaid eligibility.

Explore UHC Medicare Advantage options with hearing benefits using their online tool, or contact UHC Hearing directly for assistance.

Verifying Your Coverage: A Step-by-Step Guide

Freepik | Verifying hearing aid coverage can be challenging due to various factors.

With so many variables at play, verifying your hearing aid coverage can be a daunting task. Follow these three steps to streamline the process:

Step 1: Identify Your Needs and Gather Information Start by compiling detailed information about your hearing health, such as audiogram results, speech recognition scores, and the type of hearing loss (mild, moderate, severe, or profound). This information will help insurers determine if hearing aids are medically necessary for you.

Step 2: Check Your Policy First. Before calling your insurance provider, log in to your online patient portal. Thoroughly review your medical, dental, and any extra benefits for hearing coverage info.

Document any details you find, noting areas that need clarification.

Step 3: Call Your Insurance Provider. With your notes in hand, call them to ask any remaining questions about your coverage. Be prepared to describe your situation in detail, referencing your documented needs and plan information.

If your plan lacks hearing aid coverage, inquire about available resources or options to purchase additional coverage.

Hearing Aid Assistance Programs

Even without insurance coverage, numerous local and national assistance programs can help make hearing aids more accessible and affordable.

Hearing Aid Donation Programs

Organizations like The Hearing Aid Project, GiveHear, Lions Club, and Help America Hear collect, refurbish, and distribute donated hearing aids to those in need, often at little or no cost.

State Vocational Rehabilitation Programs

Some states provide free hearing aids through vocational rehabilitation programs designed to assist individuals with conditions like hearing and vision loss, whether employed or seeking new opportunities.

The IDEA offers free hearing aids to kids with hearing impairments. They must be school-aged, toddlers, or infants. Their IEP must say they need the aids. Contact your local school district to learn more about requesting an IEP evaluation.

Other Affordable Options

If you don’t qualify for assistance programs, consider these cost-saving strategies:

Shop for Discounts and Deals

Keep an eye out for promotions and discounts on OTC hearing aid brand websites, especially when new models are released. Some brands, like MDHearing, frequently offer discounted prices ranging from $299 to $699. For prescription devices, explore discount hearing care providers like Yes Hearing, which offers transparent, lower-cost options through remote consultations and at-home evaluations.

Financing

Many retailers and brands partner with financing companies like CareCredit to allow you to pay for hearing aids over time, often with promotional 0% interest periods based on your approved terms.

Use Your Health Savings Account (HSA) or Flexible Savings Account (FSA) If you have an employer-sponsored HSA or FSA, you can use those pre-tax funds to pay for out-of-pocket hearing aid expenses. Most major brands and retailers accept HSA and FSA payment cards at checkout.

Prioritizing Your Hearing Health

We navigate the changing landscape of hearing aid coverage. One thing remains clear: your hearing health is key. Untreated hearing loss can profoundly impact your overall well-being, from emotional and mental health to social engagement and cognitive function.

If you’re having trouble hearing, like struggling to follow conversations or needing to turn up the volume a lot, schedule a hearing evaluation with an audiologist. It could be a life-changing decision that preserves your ability to connect with the world around you and safeguards your overall quality of life.

Freepik | stefamerpik | For hearing difficulties, consult an audiologist for evaluation.

While the road to comprehensive insurance coverage may be winding, the destination – a world where everyone has access to the hearing care they need – is worth the journey. With perseverance, advocacy, and a commitment to exploring all available options, the sound of clarity can ring true for all.

Frequently Asked Questions

A pair of hearing aids. What is the average cost?

The cost of hearing aids can range widely, from $249 for basic OTC models to upwards of $7,500 for advanced prescription devices. On average, OTC hearing aids typically cost less than $3,000 per pair, while prescription aids tend to exceed that threshold.

Does Medicare cover hearing aids in 2024?

Original Medicare (Part A) does not cover hearing aids or routine exams, but Part B may cover diagnostic hearing exams deemed medically necessary by your doctor. Many Medicare Advantage (Part C) plans offered by private insurers do include hearing aid coverage, but details vary by plan and location.

Are Costco hearing aids covered by insurance?

Depending on your specific insurance plan, you may be able to use Medicare Advantage or private insurance benefits to purchase hearing aids from Costco. Contact your insurance provider to verify coverage details.

Can you get insurance for hearing aids?

Yes, various insurance plans offer coverage for hearing aids, including Medicare Advantage, Medicaid, and many private insurance options. However, the extent of coverage and eligibility criteria differ among providers.

What level of hearing loss requires hearing aids?

While any degree of hearing loss can potentially benefit from the use of hearing aids, certain insurance providers like Aetna and Tricare have strict criteria regarding the level of hearing impairment that qualifies for coverage. Be sure to check with your specific provider to understand their eligibility requirements.

Does Social Security cover hearing aids?

Unfortunately, the Social Security Administration does not provide coverage for “prescribed devices or other personal devices, such as hearing aids or cochlear implants.”

More in Well-Being

-

`

Should I Visit a Chiropractor? The Tell-Tale Signs

If you’re wrestling with persistent discomfort in areas like your neck, back, or shoulders, you’re not alone. Many Americans are intimately...

July 19, 2024 -

`

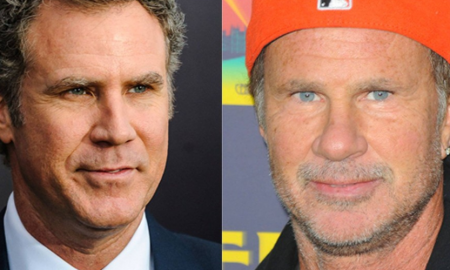

Chad Smith and Will Ferrell Drum-Off – A Night of Comedy and Music

The year was 2014. The late-night talk show landscape was abuzz with a brewing battle unlike any other. It wasn’t a...

July 8, 2024 -

`

Can Coughing Cause Back Pain?

Back pain is a common complaint among many individuals, but did you know that a simple action like coughing can exacerbate...

July 5, 2024 -

`

How to Overcome Imposter Syndrome?

Imposter Syndrome is a familiar term many recognize as a psychological state where individuals doubt their accomplishments, fearing that others will...

June 27, 2024 -

`

Which Peptides Are Best for Anti-Aging?

For those seeking to combat the signs of aging and maintain a youthful appearance, the world of skincare can feel overwhelming....

June 18, 2024 -

`

Celebrities with Celiac Disease – Inspirational Stories and Struggles

Celiac disease is a serious condition, and even the rich and famous aren’t immune. Many celebrities have been open about their...

June 10, 2024 -

`

How to Fix Poor Sleep Hygiene for Better Rest

Sleep is a fundamental human need, as crucial for our well-being as a healthy diet and regular exercise. Yet, many people...

June 6, 2024 -

`

5 Easy & Effective Ways of Coping With Depression

Depression is more than just feeling sad or having a bad day. It is a pervasive mental health condition that affects...

May 30, 2024 -

`

Top 10 Practical 60th Birthday Ideas For Everyone

Turning 60 is a milestone worth celebrating! Whether you are planning your own bash or organizing a celebration for a loved...

May 24, 2024

You must be logged in to post a comment Login