Why Do You Have to Pay a Higher Health Insurance Premium?

Americans are spending an abysmal amount of money on healthcare each year. This includes high insurance premiums, co-pays, high deductibles, and other extra expenses that include health and wellness in the country. One reason for the rising healthcare costs is the changing government health policy.

Americans are spending an abysmal amount of money on healthcare each year. This includes high insurance premiums, co-pays, high deductibles, and other extra expenses that include health and wellness in the country. One reason for the rising healthcare costs is the changing government health policy.

Changes in Medicare and Medicaid, which cater to those without a health insurance policy, are one reason for the increasing prices. Check out some of the other reasons for rising health insurance costs and why you as an individual have to pay more.

An Increasingly Aging Population

Healthcare is getting expensive because of an expanding population, and more and more people are getting older. 50% of the increase in healthcare is true because of the increased costs for services, especially inpatient hospital care. The other two next highest factors are population growth accounting for 23%, and population aging accounting for 12%. As the older population grows in number, so does their dependency on healthcare which thus increases the burden on the entire population.

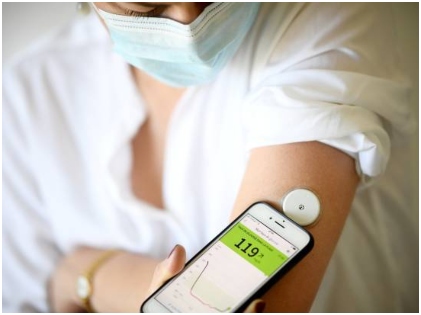

Increase in Chronic Diseases

A recent study found that diabetes is one of the medical conditions primarily responsible for increasing health insurance costs. The increasing need for diabetes medications alone has reached $44.4 billion of the $64.4 billion increase in costs to treat the disease.

The other ailments that lead to the spike in the costs are lower back and neck pain, high blood pressure, high cholesterol, urinary disease, depression, and more. Unfortunately, the more ailments you suffer from, the more premium you have to pay.

Increased Ambulatory Costs

Ambulatory care, which includes other services are outpatient hospital services, and emergency room care has been just a few of the categories studied. Outpatient costs have increased from $381.5 billion to $706.4 billion. Emergency room costs for health conditions have hiked to almost 6.4% over the same period.

Gender Rating

Before the ACA (Affordable Care Act), women buying insurance on the individual market had to pay at least 50 percent higher monthly premiums than men. In some cases, the gap rose to a significant 81 percent.

The practice is popular as gender rating. It mimics car insurance companies which charge a higher premium to insure teenage drivers. Regarding health insurance, women are at a higher risk than men because they visit doctors more frequently, live longer, and have babies.

However, thanks to Government intervention, gender rating is now illegal. Under the ACA, insurance companies cannot charge women more than men. They have to cover the total cost of certain key preventative health care women’s health services, such as doctor’s visits and contraception.

Family Size

If you buy a health insurance policy for the entire family, the premium amount you need to pay depends on various factors. One of the reasons may be the number of family members covered by the plan.

A smaller family may include two adults and one child who will have to pay less premium than a family that consists of four adults and two children. In this case, you can opt for a family floater plan or individual insurance for each family member. Usually, a family floater plan may turn out to be cheaper than an individual policy for each member.

Physical Fitness

If you are overweight or obese and lead a sedentary lifestyle, you will likely develop lifestyle disorders. This includes such as hypertension, diabetes, heart attacks, and more. As per the 2012 health statistics report by the WHO, at least one in six adults is obese. People who have a BMI of above 30 falls into the obese category.

People who have normal BMI (Body mass index) as per their age and height may pay a significantly lower premium than overweight or unfit. With increasing desk-bound jobs and people tied to their laptops. And this means that people are unfortunately leading a sedentary lifestyle. They are at a greater risk of being susceptible to lifestyle diseases. The equation is pretty simple. The more sedentary you are, the sicker you are likely to get and hence much more likely to pay a hefty health insurance premium.

When you purchase a policy, it is important to look at all the factors determining your insurance premium amount. Take quotes from different insurers. You can also speak to friends and family who have an insurance policy in place. Do your research and make a well-informed decision about the insurance policy. That way, you will not have to worry about the policy, coverage, etc. We hope you found this blog useful. Do share your thoughts, questions, and feedback in the comments section!

More in Anti-Aging

-

`

Should I Visit a Chiropractor? The Tell-Tale Signs

If you’re wrestling with persistent discomfort in areas like your neck, back, or shoulders, you’re not alone. Many Americans are intimately...

July 19, 2024 -

`

Chad Smith and Will Ferrell Drum-Off – A Night of Comedy and Music

The year was 2014. The late-night talk show landscape was abuzz with a brewing battle unlike any other. It wasn’t a...

July 8, 2024 -

`

Can Coughing Cause Back Pain?

Back pain is a common complaint among many individuals, but did you know that a simple action like coughing can exacerbate...

July 5, 2024 -

`

How to Overcome Imposter Syndrome?

Imposter Syndrome is a familiar term many recognize as a psychological state where individuals doubt their accomplishments, fearing that others will...

June 27, 2024 -

`

Which Peptides Are Best for Anti-Aging?

For those seeking to combat the signs of aging and maintain a youthful appearance, the world of skincare can feel overwhelming....

June 18, 2024 -

`

Celebrities with Celiac Disease – Inspirational Stories and Struggles

Celiac disease is a serious condition, and even the rich and famous aren’t immune. Many celebrities have been open about their...

June 10, 2024 -

`

How to Fix Poor Sleep Hygiene for Better Rest

Sleep is a fundamental human need, as crucial for our well-being as a healthy diet and regular exercise. Yet, many people...

June 6, 2024 -

`

5 Easy & Effective Ways of Coping With Depression

Depression is more than just feeling sad or having a bad day. It is a pervasive mental health condition that affects...

May 30, 2024 -

`

Top 10 Practical 60th Birthday Ideas For Everyone

Turning 60 is a milestone worth celebrating! Whether you are planning your own bash or organizing a celebration for a loved...

May 24, 2024

You must be logged in to post a comment Login