Does Health Insurance Cover Car Accidents?

One of the most pressing concerns after a car accident is the financial burden of medical expenses. So, does health insurance cover car accidents? Understanding how insurance works in these scenarios can help ease some stress during such a challenging time.

Understanding Your Auto Insurance Coverage

Auto insurance is the first line of defense for covering medical expenses after a car accident. Typically, your auto insurance policy will cover medical treatments related to injuries from the accident until the policy limit is reached. Most drivers are required to have minimum liability insurance coverage, which generally includes:

- $25,000 for bodily injury or death per person

- $50,000 for bodily injury or death for two or more people

- $20,000 for property damage

However, these limits can quickly be exceeded, especially if the injuries are severe. Once the auto insurance policy limits are exhausted, the question arises about the role of personal health insurance in covering the remaining expenses.

aleksandarlittlewolf | Freepik | Auto insurance is the first line of defense for covering medical expenses after a car accident.

Does Health Insurance Cover Car Accidents?

Once your auto insurance limits are reached, personal health insurance can indeed step in to cover additional medical costs. Health insurance coverage kicks in after other forms of payment, such as auto insurance, have been utilized. This means you’ll need to meet your health insurance deductible before the coverage begins. Co-pays and other obligations specified in your health insurance policy will also apply.

The Role of Health Insurance Deductibles

A health insurance deductible is the amount you must pay out-of-pocket before your health insurance coverage starts. For example, if your policy has a $1,000 deductible, you will need to pay that amount before your insurance covers the remaining medical expenses. This is why using auto insurance for medical costs is beneficial initially, as it can help avoid significant out-of-pocket expenses.

What Health Insurance Covers After an Auto Accident

The extent of what your health insurance covers after a car accident depends on several factors, including the type of health insurance plan you have, whether you visit an in-network provider and the specific restrictions of your policy. It’s important to note that many health insurance plans may not cover alternative treatments or medications.

For those with comprehensive health insurance plans, typical coverage includes hospitalization, emergency room visits, surgeries, follow-up appointments, and rehabilitation services. Always review your policy details to understand what is covered and what isn’t.

DC Studio | Freepik | If you have comprehensive health insurance plans, typical coverage includes hospitalization, emergency room visits, surgeries, follow-up appointments, and rehabilitation services.

What Is Subrogation?

After your health insurance pays for your medical expenses, they may seek reimbursement from the at-fault party’s insurance. This process is known as subrogation. Essentially, the health insurer claims a portion of any settlement you receive to cover the costs they incurred on your behalf.

This can significantly affect the amount of compensation you retain from a settlement. Legal assistance can help negotiate the terms of subrogation to ensure you aren’t left without necessary funds for future medical expenses and recovery needs.

Choosing the Right Health Insurance Plan

Not all health insurance plans are created equal, especially when it comes to coverage after a car accident. Each has its benefits and limitations, particularly regarding deductibles and network restrictions.

When selecting a health insurance plan, consider your healthcare needs and potential scenarios like car accidents. Some plans, like catastrophic health plans, offer low monthly premiums but have high deductibles, which might not be ideal if you require extensive medical care after an accident.

Ensuring Coverage After an Accident

If you find yourself needing medical care after a car accident, it’s crucial to seek help immediately. Hospitals and healthcare providers typically prioritize treatment, allowing insurance claims to be processed afterward. Ensuring your health insurance covers expenses includes finding a qualified healthcare provider, understanding your policy’s deductible and co-pay requirements, and getting the necessary medical treatment.

More in Health Insurance

-

`

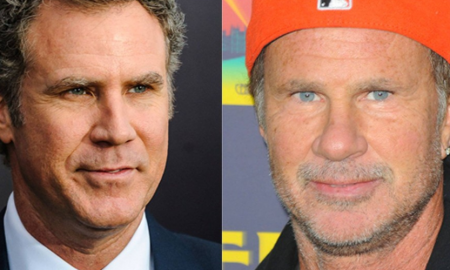

Chad Smith and Will Ferrell Drum-Off – A Night of Comedy and Music

The year was 2014. The late-night talk show landscape was abuzz with a brewing battle unlike any other. It wasn’t a...

July 8, 2024 -

`

Can Coughing Cause Back Pain?

Back pain is a common complaint among many individuals, but did you know that a simple action like coughing can exacerbate...

July 5, 2024 -

`

How to Overcome Imposter Syndrome?

Imposter Syndrome is a familiar term many recognize as a psychological state where individuals doubt their accomplishments, fearing that others will...

June 27, 2024 -

`

Which Peptides Are Best for Anti-Aging?

For those seeking to combat the signs of aging and maintain a youthful appearance, the world of skincare can feel overwhelming....

June 18, 2024 -

`

Celebrities with Celiac Disease – Inspirational Stories and Struggles

Celiac disease is a serious condition, and even the rich and famous aren’t immune. Many celebrities have been open about their...

June 10, 2024 -

`

How to Fix Poor Sleep Hygiene for Better Rest

Sleep is a fundamental human need, as crucial for our well-being as a healthy diet and regular exercise. Yet, many people...

June 6, 2024 -

`

5 Easy & Effective Ways of Coping With Depression

Depression is more than just feeling sad or having a bad day. It is a pervasive mental health condition that affects...

May 30, 2024 -

`

Top 10 Practical 60th Birthday Ideas For Everyone

Turning 60 is a milestone worth celebrating! Whether you are planning your own bash or organizing a celebration for a loved...

May 24, 2024 -

`

What is the Meaning of Angelina Jolie’s Back Tattoo? Explore

If you have ever caught a glimpse of Angelina Jolie’s back tattoo, you might have wondered, “What is the story behind...

May 17, 2024

You must be logged in to post a comment Login