Everything You Need to Know About Life Insurance

Life insurance remains one of the most important financial safety nets that you can have in life. In the event of your untimely demise, life insurance can come in handy to cover unexpected expenses and offer financial protection to those who matter most to you. With different types of life insurance policies available, choosing the right policy can be overwhelming.

However, with little presence of mind, you can choose the best life insurance policy. Something that ticks all the boxes. In this article, we will take an in-depth look at everything you need to know about life insurance policies.

What Is Life Insurance?

Essentially, life insurance is a contract between you and the insurance company. When you pass away, the insurance company pays out a lump sum to your beneficiaries as compensation for your death.

Pixabay / Pexels / Life insurance is one of the leading financial safety nets that can cover your unexpected expenses in case of emergencies.

You, as the policyholder, pay regular premiums to the insurance company in exchange for the coverage.

What Are the Main Types of Life Insurance?

There are two main types of life insurance policies: Term and permanent insurance. The term life insurance policy provides coverage over a set period. It is an affordable option with no cash value accumulation.

Permanent insurance is a lifelong policy. It has a cash value component and can serve as a valuable investment tool. However, it is more expensive than term insurance.

Why Is Life Insurance Important?

Life insurance is important because it can help financially protect your beneficiaries. Similarly, it can prevent you from facing financial difficulties in the event of your untimely death.

August / Pexels / Term and Permanent Insurances are the two main types of life insurance.

Essentially, this type of insurance covers:

- Funeral expenses

- End-of-life medical bills

- Mortgage payments

- Pay off debts

- Other financial obligations.

How Much Life Insurance Do You Need?

The amount of life insurance needed largely depends on your personal financial situation. Plus, the number of dependants that you have. You will need to calculate all your expenses, from medical bills to mortgage payments and debt.

Similarly, you should also factor in the cost of your children’s college education. You will want to choose a policy that covers all these expenses and more.

Faux / Pexels / Your life insurance depends on your personal financial situation and expenses.

Who Needs Life Insurance?

The answer is simple: Anyone with family and dependents needs life insurance. Particularly, it is important for people with debt, a mortgage, and young children.

Life insurance can help ensure that your beneficiaries will not be left with a financial burden in case of your death.

Quick Sum Up & Recap

Life insurance is an essential part of your family’s long-term financial plan. With proper knowledge, you can choose the right policy that best suits your needs and budget.

Remember, the cost of life insurance increases as you age. So, the sooner you take out a policy, the better. Do your research and choose a policy that provides adequate coverage for your loved ones in the event of your death. This way, you will be in the position to choose the perfect insurance policy. Something that ticks all the boxes.

More in Anti-Aging

-

`

Should I Visit a Chiropractor? The Tell-Tale Signs

If you’re wrestling with persistent discomfort in areas like your neck, back, or shoulders, you’re not alone. Many Americans are intimately...

July 19, 2024 -

`

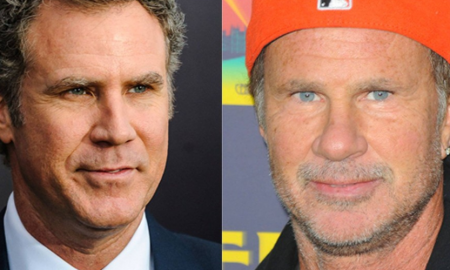

Chad Smith and Will Ferrell Drum-Off – A Night of Comedy and Music

The year was 2014. The late-night talk show landscape was abuzz with a brewing battle unlike any other. It wasn’t a...

July 8, 2024 -

`

Can Coughing Cause Back Pain?

Back pain is a common complaint among many individuals, but did you know that a simple action like coughing can exacerbate...

July 5, 2024 -

`

How to Overcome Imposter Syndrome?

Imposter Syndrome is a familiar term many recognize as a psychological state where individuals doubt their accomplishments, fearing that others will...

June 27, 2024 -

`

Which Peptides Are Best for Anti-Aging?

For those seeking to combat the signs of aging and maintain a youthful appearance, the world of skincare can feel overwhelming....

June 18, 2024 -

`

Celebrities with Celiac Disease – Inspirational Stories and Struggles

Celiac disease is a serious condition, and even the rich and famous aren’t immune. Many celebrities have been open about their...

June 10, 2024 -

`

How to Fix Poor Sleep Hygiene for Better Rest

Sleep is a fundamental human need, as crucial for our well-being as a healthy diet and regular exercise. Yet, many people...

June 6, 2024 -

`

5 Easy & Effective Ways of Coping With Depression

Depression is more than just feeling sad or having a bad day. It is a pervasive mental health condition that affects...

May 30, 2024 -

`

Top 10 Practical 60th Birthday Ideas For Everyone

Turning 60 is a milestone worth celebrating! Whether you are planning your own bash or organizing a celebration for a loved...

May 24, 2024

You must be logged in to post a comment Login