Why opt for a Multi-year health care insurance policy?

People often neglect health care insurance policies, especially in Southeast Asian countries like India and Pakistan and other underdeveloped countries. They used to have a strong faith that nothing could happen wrong and that paying premiums for health insurance was just an additional financial burden. However, after the pandemic hit the world and people had to pay substantial medical expenses and hospital bills, they realized the importance of medical insurance policies. Because of this, there is a drastic increase in demand for health care policies.

Besides Covid’19, there is a constant rise in health problems due to increased global pollution and people’s unhealthy lifestyle. Hence, the need for a medical insurance policy will continue to grow even after the coronavirus vanishes from the earth.

Besides Covid’19, there is a constant rise in health problems due to increased global pollution and people’s unhealthy lifestyle. Hence, the need for a medical insurance policy will continue to grow even after the coronavirus vanishes from the earth.

Masses are much educated about the benefits of health care insurance policies for the whole family as they are experienced in paying hefty medical bills. But people are often confused about whether they should opt for a single-year or a multi-year health care insurance. We advise people to go for a multi-year health care policy. In this article, we inform you related a few benefits to support our opinion.

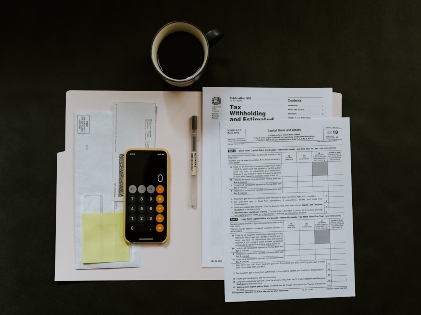

Avail premium discounts

Insurance policy sellers usually offer discounts on monthly premiums to customers interested in buying the multi-year policy as they get into a long-term contract with a respective customer. The offered discount on premiums is often around 7% to 15%. This enables the multi-year policy customer to have some extra savings in their monthly income. Such deals are not generally provided to customers looking for a year insurance policy.

Enjoy Tax Benefits

According to a few resources, people who buy multi-year insurance policies can enjoy more tax benefits than single-year policyholders. For example, in India, a new ruling has been passed. Following it, under section 80D of the Income Tax Act, citizens can avail of the tax benefits of up to Rs 25000 in monthly premiums in a year for themselves and their family members. However, under a multi-year health insurance plan, a one-time bonus can be proportionately split each year to avail of the maximum tax benefits. For example, if a person pays a premium of Rs 36000 for a three-year plan, he can enjoy a tax emption of Rs 12000 yearly.

According to a few resources, people who buy multi-year insurance policies can enjoy more tax benefits than single-year policyholders. For example, in India, a new ruling has been passed. Following it, under section 80D of the Income Tax Act, citizens can avail of the tax benefits of up to Rs 25000 in monthly premiums in a year for themselves and their family members. However, under a multi-year health insurance plan, a one-time bonus can be proportionately split each year to avail of the maximum tax benefits. For example, if a person pays a premium of Rs 36000 for a three-year plan, he can enjoy a tax emption of Rs 12000 yearly.

Avoid inflation

Global inflation is at its peak and continuously increasing annually, pushing the prices of all commodities upward. Therefore, the cost of health care policies will also rise over time. By opting for a multi-year insurance policy, the holder can avoid the effect of inflation on his monthly premiums as a multi-year insurance policy locks the price of monthly premiums for the next two to three years. On the other hand, single-year policyholders have to bear the burden of inflation in the form of increased revised prices of premiums over the years.

Lock-in Advantage

The price of monthly premiums for a 40-year-old person can be 30% to 40% more than what is offered to a 30-year-old person. As the person ages, the premium amount increases simultaneously. And as the multi-year insurance policy locks the monthly premium expense, choosing a multi-year plan allows the holder to enjoy the lock advantage for the next 2-3 years. This, in turn, will help the holder escape potential annual raises in premium costs.

Escape from every year’s hassle

Multi-year health policyholders are prevented from the hassle of revising, reviewing, and bargaining the policies from the seller. The multi-year policy provides peace to the holder for the next two to three years as all the terms and conditions remain unchanged over the policy’s tenure.

Multi-year health policyholders are prevented from the hassle of revising, reviewing, and bargaining the policies from the seller. The multi-year policy provides peace to the holder for the next two to three years as all the terms and conditions remain unchanged over the policy’s tenure.

Conclusion

Health care policy is essential for every family, and choosing a multi-year medical insurance policy provides additional perks over single-year policies. However, multi-year insurance policies are suitable for people who can afford to pay a hefty amount of money in one go.

A health insurance plan should be considered your friend for a lifetime. Multi-year or not, the importance of a health insurance plan cannot be ignored and should be your top priority.

More in Anti-Aging

-

`

6 Unique Approaches to Finding Meaning in Life

Have you ever gazed at a starry sky and pondered the vastness of existence, wondering what your place is in it...

March 5, 2024 -

`

Want to Look Like a Royal For a Week? Try These Creative Budget-Friendly Tips

Have you ever caught yourself daydreaming about strolling through the halls of a grand palace, donning an outfit that screams elegance,...

February 26, 2024 -

`

Famous Celebrities Who Admitted to Mental Health & Personal Struggles

In a world where fame often seems like the ultimate achievement, the glitz and glamour often overshadow the personal struggles many...

February 19, 2024 -

`

Mastering Medicare – 5 Expert Tips for Maximum Benefit

Are you ready to harness the full potential of your Medicare benefits? From managing your prescriptions to staying on top of...

February 12, 2024 -

`

Struggling With Bipolar Disorder? Lifestyle Changes You Should Make for Stability

Introduction: The Rollercoaster of Bipolar Disorder Living with bipolar disorder is akin to riding an emotional rollercoaster. One moment, you’re soaring...

February 7, 2024 -

`

Swipe Right…or Left? 3 Crucial Questions Before Your Next Beauty Haul

Remember that thrill of unboxing a shiny new beauty product? The promise of glowing skin, luscious locks, or eyes that sparkle...

February 3, 2024 -

`

Tammy Slaton of 1000-Lb. Sisters Opens Up About Her Lesbian Journey After Losing Husband

In a world where authenticity often takes a backseat, Tammy Slaton, the spirited personality from “1000-Lb. Sisters,” brings a refreshing dose...

January 27, 2024 -

`

From Registration to Receiving: How to Enroll in Toys for Tots

The holiday season is a time of joy and celebration, but for families facing financial challenges, ensuring that their children experience...

January 16, 2024 -

`

How to Practice Self-Care? 5 Tried & Trusted Tips

Self-care is a buzzword that has been tossed around a lot lately, but what does it really mean? At its core,...

January 9, 2024

You must be logged in to post a comment Login